How well would you do in predicting the sale price of artworks in a high-stakes auction like Sotheby's or Phillips where a single painting can sell for more than one hundred million dollars? Last week I found out for myself when I finished second in Art Market Monitor's first cash entry fantasy contest. This is the first paid fantasy art auction that I am aware of, so I thought others might find the strategy I used to finish in second place interesting.

The game is played by allocating a £6M budget across a list of 27 lots (works at auction). The price of each lot is based on its pre-auction low estimate. You win the game by buying the combination of work that achieves the highest hammer price at auction. The buy-in for the fantasy contest was $100. AMM's readership is mostly art collectors and art market professionals, so the competition was strong.

See the table below for a listing of all works in the fantasy auction ranked by their fantasy ROI or (net profit / cost of investment) x 100. As with fantasy sports, the player who has the highest ROI wins. The lots with green checkmarks are my selections.

Strategy #1 What Sports Betters Know

If having a strategy for picking winners is helpful, having a strategy for avoiding losers is even more helpful. For this, I looked to the sports-betting industry. In the United States, more people bet on football than any other sport ($93B annually). Ironically, football is the hardest sport for a gambler to make any money on. Why? Because casinos put their best bookmakers on the sports where they have the most at risk. I theorized that auction houses would do just the same and spend the most time appraising lots with the highest estimates. For this reason, I selected just one out of the eleven most expensive lots in the contest. You can see how this paid off in the chart below.

There appears to be a general trend for higher estimate works returning lower ROI. Had I followed my own strategy closer and laid off the £3m Mark Rotjahn lot (13% ROI), I would likely have won the contest.

Strategy #2 - Like Shopping for a Car

I found it helpful to break down the artists' works into segments for appraisal. Similar to car companies, artists have top, middle, and lower level segments. So when I looked at an auction lot, I would first ask, "Is this a Lexus, a Camry, or a Yaris for this artist?" I would then look for comparison works (comps) within that same segment based on visual similarity, year of execution, materials, and dimensions. Based on the past selling price for the comps, I could then establish my own estimates. If my estimate for a lot was in Lexus territory, but the low estimate from the auction house was for a Yaris, then I knew I had a winner. This strategy helped me select four of the six lots with the highest ROI in the contest. Below I show the comps I used, any key pre-auction insights, and a graph of the average price per work over time.

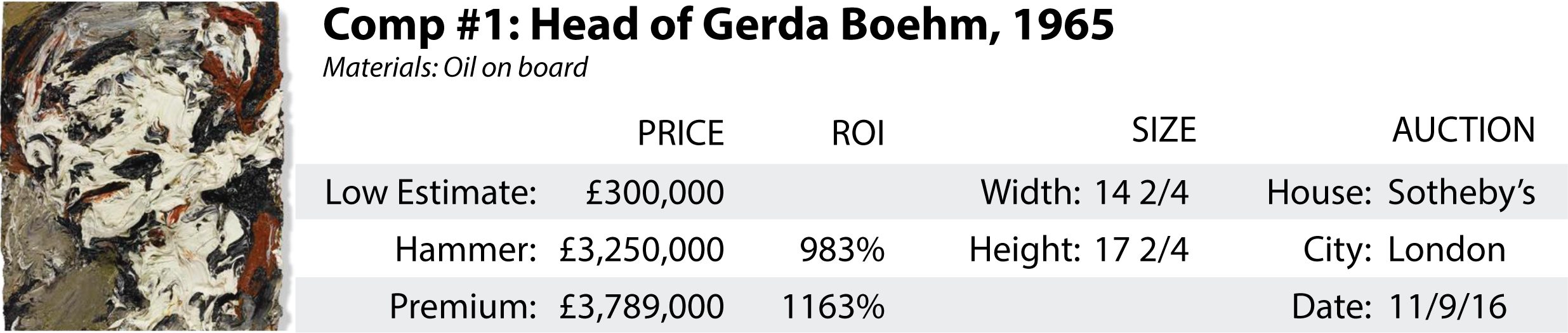

Frank Auerbach - Head of Gerda Boehm

Rank #6: - Hammer Price: £820,000 (£320,000 return on £500,000 invested for 64% ROI)

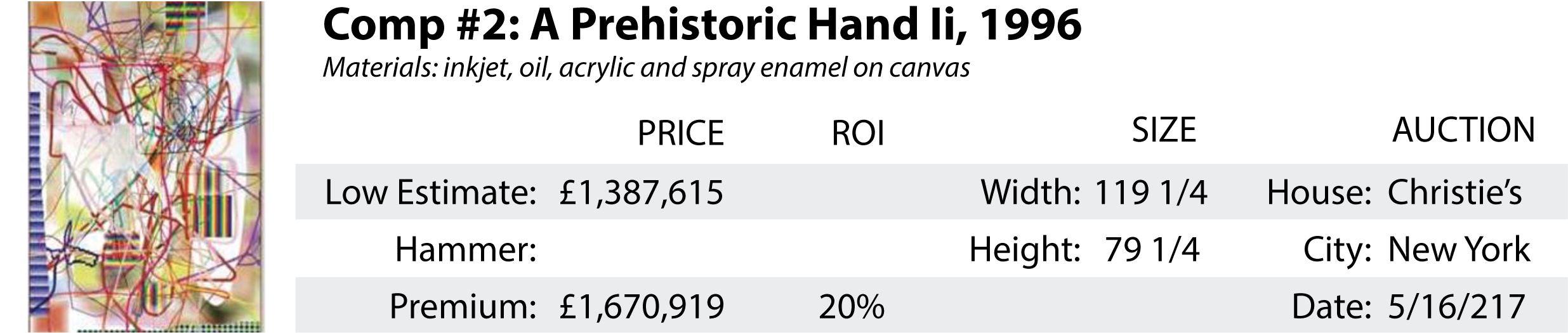

The Good: I couldn't have asked for better comps for the Auerbach lot. The comps had the same title and the same model in roughly the same pose. One of the comps previously owned by David Bowie sold late last year for £3.3m setting a new record for Auerbach. Not only were the comps extremely similar, but they had both achieved insanely high ROI at 983% and 640%.

The Bad: The materials for the work on the block were oil on paper on board and the version that sold last year was just oil on board. I was a little concerned that the paper may devalue the lot in the contest until I found the second comp, a charcoal on paper of the same subject which sold for over £2m. I really thought this lot could end up having the best ROI in the contest based on the comps.

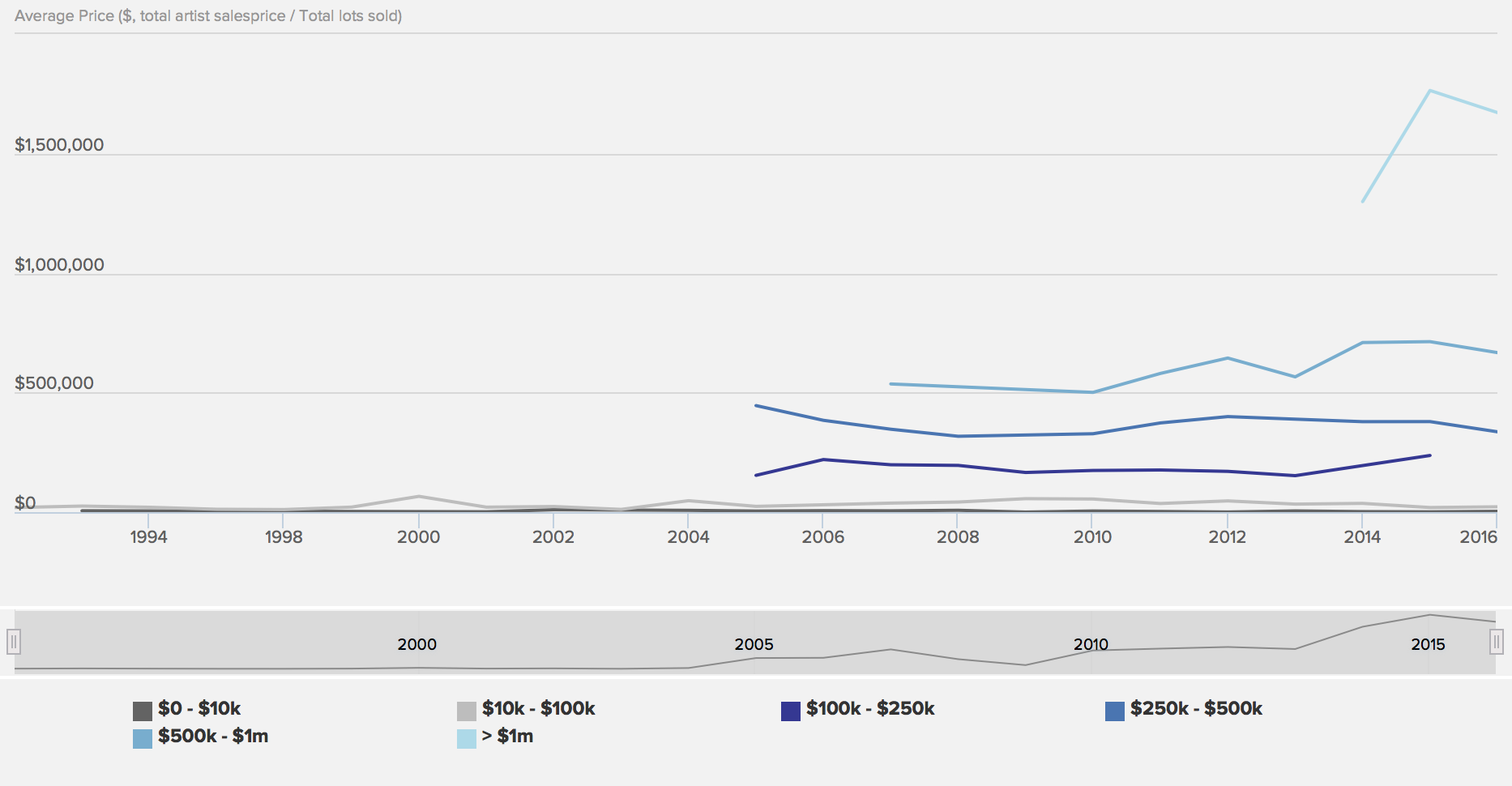

Auerbach'S AVERAGE PRICE PER WORK SOLD AT AUCTION

Frank Auerbach Average Price at Auction | AucionClub.com

Albert Oehlen - Nie Mehr Unter Dem Exkrement Liegen

Rank #5: - Hammer Price: $550,000 (£250,000 net profit on £300,000 invested for 83% ROI)

The Good: There were actually two Oehlen works scheduled to go to auction the week of the fantasy contest. The work that was not in the contest, Abyss, had a low estimate of £1m, more three times higher than the work in the contest. The top end of Oehlen's market has also been expanding into new territory over the last few years with several works selling for £1M plus.

The Bad: The date of execution across the comps spans five years with the lot in the contest being the most recent. I had a theory that the earlier works within that style might be seen as more original and less derivative, and therefore, potentially more valuable. That may explain some of the discrepancies across the final premium prices.

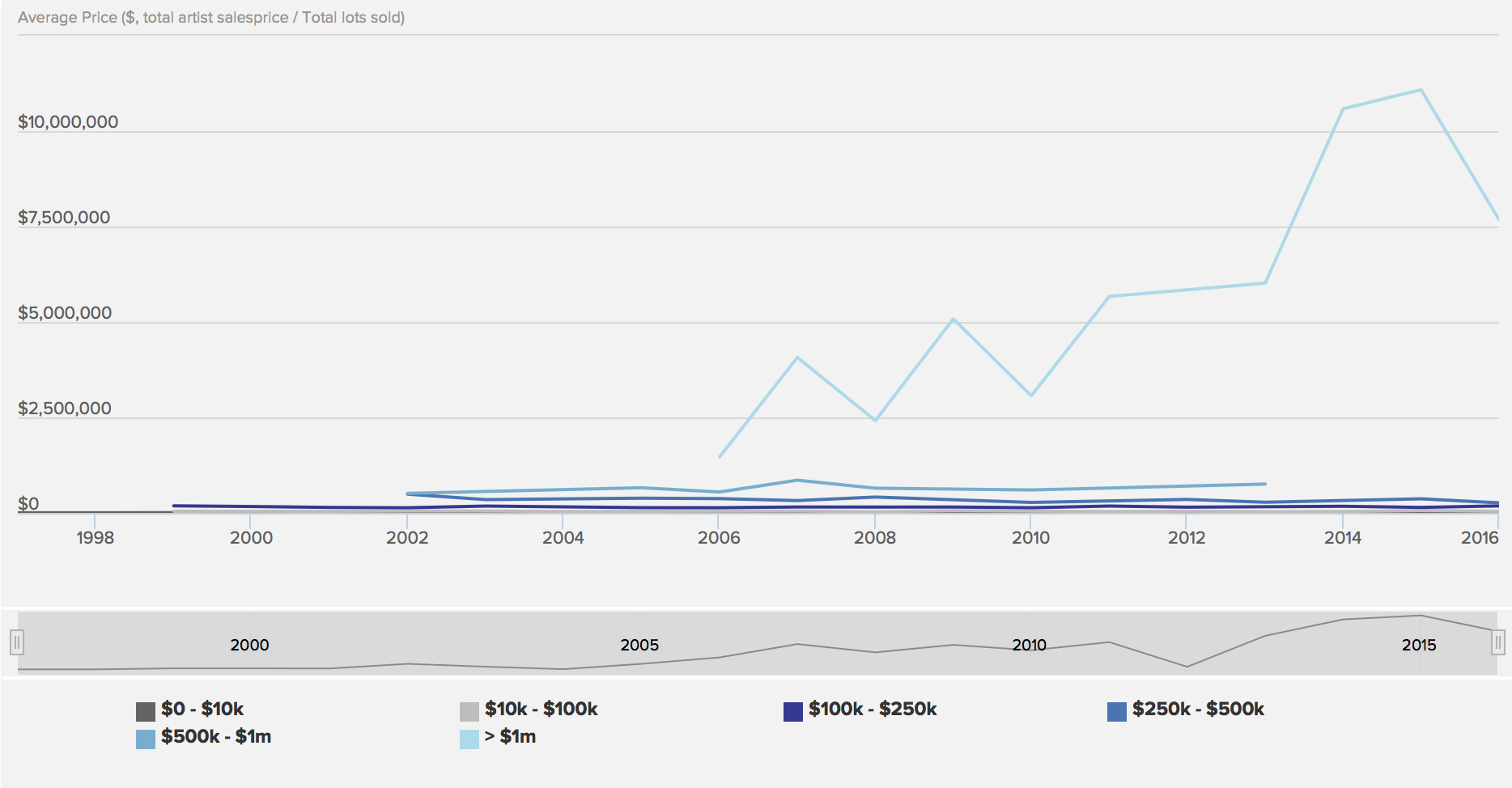

Oehlen'S AVERAGE PRICE PER WORK SOLD AT AUCTION

Albert Oehlen Average Price at Auction | AucionClub.com

Peter Doig - Tunnel Painting (Country-rock)

Rank #3 - Hammer Price: £960,000 (£460,000 net profit on £500,000 invested for 92% ROI)

The Good: I am not a Doig expert, but the three paintings below look very similar, to me which makes for strong comps. The premiums for the two comps were sky high at £2.7m and £8.5m, especially when compared to the £500k low estimate for the lot on the block.

The Bad: While the paintings are visually similar, the dimensions of the works vary greatly with the work on the block being the smallest by far. There are also several years between the sale dates, which likely weakens the comps.

Doig's Average Price Per Work Sold at Auction

Peter Doig Average Price at Auction | AucionClub.com

Wolfgang Tillmans - Freischwimmer #84

Rank #1 - Hammer Price: £500,000 ( £300,000 net profit on £200,000 invested for 150% ROI )

The Good: The Tillmans' comps had two major strengths: first, both comps were sold at auction just a month prior; second, both comps had premiums that greatly exceeded their low estimates. This was a strong signal to me that collectors are willing to pay much more than the low estimates for these works.

The Bad: Not much bad here, not surprised this was the top performing lot. This lot had the best ROI at 150% but the ROI was on a very small investment at £200k (tied for lowest in the contest), which limited my return.

Tilmans Average PRice Per work sold at auction

Wolfgang Tillmans Average Price at Auction | AucionClub.com

Moving forward

Fantasy art auction was every bit as fun as playing fantasy sports. I was able to watch the the live video feed of the Sotheby's sale and found myself riveted as I rooted hard for my lots. I would be surprised if fantasy auction does not catch on and become a much bigger thing. I can't possibly be the only fantasy sports / art nerd out there.

To improve my strategy moving forward, I am planning on running some analysis on my analytical art database to answer some questions that came up during the contest:

- Is the ROI really better for less expensive lots vs. more expensive lots?

- Which auction houses have estimates closest to the hammer price?

- Are certain types of art more difficult to estimate than others (sculpture, paintings, drawings)?

- Are estimates for newer works more or less accurate than estimates for older works?

Would you play in a fantasy art auction? What would be your strategy? How well do you think you would fare against the competition? I am always up for nerding out on art and data. If you have thoughts on other things I should be factoring into my model or would like to learn more about my analytical art database (the largest of its kind), hit me up at jason@artnome.com.

Interested in getting your hands on some data or helping us to build the largest database of known works across the world's most important artists? Join the free Artnome Slack community.